%203.png)

%203.png)

- Transfers to or from External Accounts may be made in amounts of up to $50,000 per transaction or a maximum of $100,000 per day in the aggregate from all your combined accounts.

- Transfers between deposit accounts held by us and an External Account that we receive by the Cutoff Time on any Business Day will begin processing on the same day. Transfers to an External Account will be deducted from your From Account held by us on the calendar date and will usually be reflected in your External Account on the Deliver By date. Transfers from External Accounts are subject to the processing times of the financial institution holding your External Account. Instructions for transfers from External Accounts that we receive by the Cutoff Time on a Business Day will be sent to the holder of your External Account on the same day for processing. Instructions entered via the Bank2Bank Transfer Service may be Cancelled until the Cutoff Time on the Send On date.

- Transfer instructions relating to External Accounts and the transmission and issuance of data related to such instructions shall be received pursuant to the terms of this Agreement and the rules of the National Automated Clearing House Association ("NACHA") and the applicable automated clearing house ("Regional ACH") (collectively, the "Rules") and you and we agree to be bound by such Rules as in effect from time to time. In accordance with such Rules, any credit to your deposit account held by us or your External Account shall be provisional until such credit has been finally settled by us or the third party institution which holds your External Account, as the case may be. You acknowledge that you have received notice of this requirement and of the fact that if we do not receive final settlement for a transfer for any reason, we shall charge back the amount of such transfer to the Transfer To or From Account (as applicable) or any other of your accounts or claim a refund from you.

For purposes of this disclosure and agreement the terms "we", "us" and "our" refer to Bank of San Francisco. The terms "you" and "your" refer to the recipient of this disclosure and agreement.

The Electronic Fund Transfer Act and Regulation E require institutions to provide certain information to customers regarding electronic fund transfers (EFTs). This disclosure applies to any EFT service you receive from us related to an account established primarily for personal, family or household purposes. Examples of EFT services include direct deposits to your account, automatic regular payments made from your account to a third party and one-time electronic payments from your account using information from your check to pay for purchases or to pay bills. This disclosure also applies to the use of your Mastercard Debit Card (Personal) (hereinafter referred to collectively as "Debit Card") at automated teller machines (ATMs) and any networks described below.

TERMS AND CONDITIONS. The following provisions govern the use of EFT services through accounts held by Bank of San Francisco which are established primarily for personal, family or household purposes. If you use any EFT services provided, you agree to be bound by the applicable terms and conditions listed below. Please read this document carefully and retain it for future reference.

DEFINITION OF BUSINESS DAY. Business days are Monday through Friday excluding holidays.

ELECTRONIC FUND TRANSFER SERVICES PROVIDED

DEBIT CARD SERVICES. The services available through use of your Debit Card are described below.

MASTERCARD DEBIT CARD (PERSONAL) SERVICES:

- You may withdraw cash from your checking account(s), savings account(s), money market account(s), and NOW account(s).

- You may transfer funds between your checking and savings accounts, checking and money market accounts, checking and NOW accounts, savings and money market accounts, savings and NOW accounts, and NOW accounts and money market accounts.

- You may make balance inquiries on your checking account(s), savings account(s), money market account(s), and NOW account(s).

- You may use your card at any merchant that accepts Mastercard® Debit Cards for the purchase of goods and services.

NETWORK. Your ability to perform the transactions or access the accounts set forth above depends on the location and type of ATM you are using and the network through which the transaction is being performed. A specific ATM or network may not perform or permit all of the above transactions.

You may access your Debit Card through the following network(s): Star, Accel, MoneyPass.

ATM FEES. When you use an ATM not owned by us, you may be charged a fee by the ATM operator or any network used, and you may be charged a fee for a balance inquiry even if you do not complete a fund transfer.

OTHER ATM SERVICES. In addition, you may perform the following transactions: None.

Notwithstanding anything to the contrary in the preceding paragraphs, Bank of San Francisco will automatically reimburse you all ATM operator and network fees.

POINT OF SALE TRANSACTIONS. Listed below is the card you may use to purchase goods and services from merchants that have arranged to accept your card as a means of payment (these merchants are referred to as "Participating Merchants"). Some Participating Merchants may permit you to receive cash back as part of your purchase. Purchases made with your card, including any purchase where you receive cash, are referred to as "Point of Sale" transactions and will cause your "designated account" to be debited for the amount of the purchase. We have the right to return any check or other item drawn against your account to ensure there are funds available to pay for any Point of Sale transaction. We may, but do not have to, allow transactions which exceed your available account balance or, if applicable, your available overdraft protection. If we do, you agree to pay an amount equal to the overdrawn balance plus any overdraft fees.

The following card and the corresponding designated account(s) may be used for Point of Sale transactions:

- Mastercard Debit Card (Personal): checking account.

Your Debit Card may also be used to obtain cash from your designated account(s) at participating financial institutions when so authorized under the terms of your Account Agreement.

CURRENCY CONVERSION - Mastercard®. If you perform transactions with your card with the Mastercard® logo in a currency other than US dollars, Mastercard International Inc. will convert the charge into a US dollar amount. At Mastercard International they use a currency conversion procedure, which is disclosed to institutions that issue Mastercard®. Currently the currency conversion rate used by Mastercard International to determine the transaction amount in US dollars for such transactions is based on rates observed in the wholesale market or government-mandated rates, where applicable. The currency conversion rate used by Mastercard International is generally the rate of the applicable currency on the date that the transaction occurred. However, in limited situations, particularly where transactions are submitted to Mastercard International for processing are delayed, the currency conversion rate used may be the rate of the applicable currency on the date that the transaction is processed.

PREAUTHORIZED TRANSFER SERVICES.

- You may arrange for the preauthorized automatic deposit of funds to your checking account(s), savings account(s), and money market account(s).

- You may arrange for the preauthorized automatic payments or other transfers from your checking account(s), savings account(s), and money market account(s).

SERVICES PROVIDED THROUGH USE OF ONLINE BANKING. Bank of San Francisco offers its customers use of our Online Banking service.

- View account balances on eligible accounts

- Review transactions on eligible accounts

- Bill Pay

- Transfer Funds between eligible accounts you own at Bank of San Francisco

- Transfer Funds to and from eligible accounts you own at External Financial Institutions

- Deposit of single checks through your Mobile Banking app. (iOS and Android only)

ELECTRONIC CHECK CONVERSION. If your account is a checking account, you may authorize a merchant or other payee to make a one-time electronic payment from this account using information from your check to pay for purchases or to pay bills.

LIMITATIONS ON TRANSACTIONS

TRANSACTION LIMITATIONS - MASTERCARD DEBIT CARD (PERSONAL).

CASH WITHDRAWAL LIMITATIONS. You may withdraw up to $1,050.00 through use of ATMs in any one day.

POINT OF SALE LIMITATIONS. You may buy up to $2,500.00 worth of goods or services in any one day through use of our Point of Sale service.

OTHER WITHDRAWAL LIMITATIONS. The terms of your account(s) may limit the number of withdrawals you may make each month. Restrictions disclosed at the time you opened your account(s), or sent to you subsequently will also apply to your electronic withdrawals and electronic payments unless specified otherwise.

OTHER LIMITATIONS.

- We reserve the right to impose limitations for security purposes at any time.

LIMITS ON TRANSFERS FROM CERTAIN ACCOUNTS. We may limit the number of checks, telephone transfers, online transfers, and preauthorized electronic transfers to an account you have with us and to third parties (including Point of Sale transactions) from money market and savings type accounts. You may be limited to six (6) such transactions from each savings or money market account you have per statement period for purposes of making a payment to a third party or by use of a telephone, computer, or wireless handheld device. Please refer to the Account Agreement for more information regarding transaction limitations.

NOTICE OF RIGHTS AND RESPONSIBILITIES

The use of any electronic fund transfer services described in this document creates certain rights and responsibilities regarding these services as described below.

RIGHT TO RECEIVE DOCUMENTATION OF YOUR TRANSFERS.

TRANSACTION RECEIPTS. Depending on the location of an ATM, you may not be given the option to receive a receipt if your transaction is $15.00 or less. Upon completing a transaction of more than $15.00, you will receive a printed receipt documenting the transaction (unless you choose not to get a paper receipt). These receipts (or the transaction number given in place of the paper receipt) should be retained to verify that a transaction was performed. A receipt will be provided for any transaction of more than $15.00 made with your Debit Card at a Participating Merchant. If the transaction is $15.00 or less, the Participating Merchant is not required to provide a receipt.

PERIODIC STATEMENTS. If your account is subject to receiving a monthly statement, all EFT transactions will be reported on it. If your account is subject to receiving a statement less frequently than monthly, then you will continue to receive your statement on that cycle, unless there are EFT transactions, in which case you will receive a monthly statement. In any case you will receive your statement at least quarterly.

PREAUTHORIZED DEPOSITS. If you have arranged to have direct deposits made to your account at least once every 60 days from the same person or company:

-

- you can call us at (415)744-6700 to find out whether or not the deposit has been made.

USING YOUR CARD AND PERSONAL IDENTIFICATION NUMBER ("PIN"). In order to assist us in maintaining the security of your account and the terminals, the Debit Card remains our property and may be revoked or canceled at any time without giving you prior notice. You agree not to use your Debit Card for a transaction that would cause your account balance to go below zero, or to access an account that is no longer available or lacks sufficient funds to complete the transaction, including any available line of credit. We will not be required to complete any such transaction, but if we do, we may, at our sole discretion, charge or credit the transaction to another account; you agree to pay us the amount of the improper withdrawal or transfer upon request.

Certain transactions involving your Debit Card require use of your PIN. Your PIN is used to identify you as an authorized user. Because the PIN is used for identification purposes, you agree to notify Bank of San Francisco immediately if your Debit Card is lost or if the secrecy of your PIN is compromised. You also agree not to reveal your PIN to any person not authorized by you to use your Debit Card or to write your PIN on your Debit Card or on any other item kept with your Debit Card. We have the right to refuse a transaction on your account when your Debit Card or PIN has been reported lost or stolen or when we reasonably believe there is unusual activity on your account.

The security of your account depends upon your maintaining possession of your Debit Card and the secrecy of your PIN. You may change your PIN if you feel that the secrecy of your PIN has been compromised. You may change your PIN via the telephone.

RIGHTS REGARDING PREAUTHORIZED TRANSFERS.

RIGHTS AND PROCEDURES TO STOP PAYMENTS. If you have instructed us to make regular preauthorized transfers out of your account, you may stop any of the payments. To stop a payment,

call us at: (415)744-6700

or

write to:

Bank of San Francisco

345 California Street, Suite 1600

San Francisco, CA 94104

We must receive your call or written request at least three (3) business days prior to the scheduled payment. If you call, please have the following information ready: your account number, the date the transfer is to take place, to whom the transfer is being made and the amount of the scheduled transfer. If you call, we will require you to put your request in writing and deliver it to us within fourteen (14) days after you call.

NOTICE OF VARYING AMOUNTS. If you have arranged for automatic periodic payments to be deducted from your checking or savings account and these payments vary in amount, you will be notified by the person or company ten (10) days before each payment, when it will be made and how much it will be.

OUR LIABILITY FOR FAILURE TO STOP PREAUTHORIZED TRANSFER PAYMENTS. If you order us to stop one of the payments and have provided us with the information we need at least three (3) business days prior to the scheduled transfer, and we do not stop the transfer, we will be liable for your losses or damages.

YOUR RESPONSIBILITY TO NOTIFY US OF LOSS OR THEFT. If you believe your Debit Card or PIN or internet banking access code has been lost or stolen,

call us at: (833)917-2180 (24 Hours a Day, 7 Days a Week.) or (415)744-6700 (Monday Through Friday, except Holidays, between 9:00am and 4:30pm PST)

or

write to:

Bank of San Francisco

345 California Street, Suite 1600

San Francisco, CA 94104

You should also call the number or write to the address listed above if you believe a transfer has been made using the information from your check without your permission.

CONSUMER LIABILITY. Tell us AT ONCE if you believe your Debit Card or PIN or internet banking access code has been lost or stolen or if you believe that an electronic fund transfer has been made without your permission using information from your check. Telephoning is the best way of keeping your possible losses down. You could lose all the money in your account (plus your maximum overdraft line of credit, if applicable). If you tell us within two (2) business days after you learn of the loss or theft of your Debit Card or PIN or internet banking access code you can lose no more than fifty dollars ($50) if someone used your Debit Card or PIN or internet banking access code without your permission. If you do NOT tell us within two (2) business days after you learn of the loss or theft of your Debit Card or PIN or internet banking access code and we can prove we could have stopped someone from using your Debit Card or PIN or internet banking access code without your permission if you had given us notice, you can lose as much as five hundred dollars ($500).

Also, if your statement shows transfers you did not make, including those made by card, code, or other means, tell us at once. If you do not tell us within sixty (60) days after the statement was transmitted to you, you may not receive back any money you lost after the sixty (60) days, and therefore, you may not get back any money in your account, if we can prove that we could have stopped someone from taking the money had you given us notice in time. If a good reason (such as a long trip or hospital stay) keeps you from giving the notice, we will extend the time periods.

CONSUMER LIABILITY FOR UNAUTHORIZED TRANSACTIONS INVOLVING MASTERCARD DEBIT CARD (PERSONAL). The limitations on your liability for unauthorized transactions described above generally apply to all electronic fund transfers. However, different limitations apply to certain transactions involving your card with the Mastercard® branded card.

If you promptly notify us about an unauthorized transaction involving your card and the unauthorized transaction took place on your Mastercard® branded card, including any PIN-based ATM or POS transactions, zero liability will be imposed on you for the unauthorized transaction. In order to qualify for the zero liability protection, you must have exercised reasonable care in safeguarding your card from the risk of loss or theft and, upon becoming aware of such loss or theft, promptly reported the loss or theft to us.

ILLEGAL USE OF MASTERCARD DEBIT CARD (PERSONAL). You agree not to use your Mastercard Debit Card (Personal) for any illegal transactions, including internet gambling and similar activities.

IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR TRANSACTIONS. In case of errors or questions about your electronic fund transfers,

call us at: (415)744-6700

or

write to:

Bank of San Francisco

345 California Street, Suite 1600

San Francisco, CA 94104

or

email us at: clientsupport@bankbsf.com

Notification should be made as soon as possible if you think your statement or receipt is wrong or if you need more information about a transaction listed on the statement or receipt. You must contact Bank of San Francisco no later than 60 days after we sent you the first statement on which the problem or error appears. You must be prepared to provide the following information:

- Your name and account number.

- A description of the error or transaction you are unsure about along with an explanation as to why you believe it is an error or why you need more information.

- The dollar amount of the suspected error.

If you provide oral notice, you will be required to send in your complaint or question in writing within ten (10) business days.

We will determine whether an error occurred within ten (10) business days (twenty (20) business days for new accounts) after we hear from you and will correct any error promptly. If we need more time, however, we may take up to forty-five (45) days (ninety

(90) days for new accounts and foreign initiated or Point of Sale transfers) to investigate your complaint or question. If we decide to do this, we will credit your account within ten (10) business days (twenty (20) business days for new accounts) for the amount which you think is in error, so that you will have the use of the money during the time it takes to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within ten (10) business days, we may not credit your account. The extended time periods for new accounts apply to all electronic fund transfers that occur within the first thirty

(30) days after the first deposit to the account is made, including those for foreign initiated or Point of Sale transactions.

We will tell you the results within three (3) business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in our investigation.

LIABILITY FOR FAILURE TO COMPLETE TRANSACTION. If we do not complete a transfer to or from your account on time or in the correct amount according to our agreement with you, we will be liable for your losses or damages as provided by law. However, there are some exceptions. We will NOT be liable, for instance:

- If through no fault of ours, you do not have enough money in your account to make the transfer.

- If the transfer would result in your exceeding the credit limit on your line of credit, if you have one.

- If the electronic terminal was not working properly and you knew about the breakdown before you started the transfer.

- If circumstances beyond our control (such as fire or flood, computer or machine breakdown, or failure or interruption of communications facilities) prevent the transfer, despite reasonable precautions we have taken.

- If we have terminated our Agreement with you.

- When your Debit Card has been reported lost or stolen or we have reason to believe that something is wrong with a transaction.

- If we receive inaccurate or incomplete information needed to complete a transaction.

- In the case of preauthorized transfers, we will not be liable where there is a breakdown of the system which would normally handle the transfer.

- If the funds in the account are subject to legal action preventing a transfer to or from your account.

- If the electronic terminal does not have enough cash to complete the transaction.

Fee Schedule. The Fee Schedule referred to above is being provided separately and is incorporated into this document by reference. Additional copies of the schedule may be obtained from Bank of San Francisco upon request.

DISCLOSURE OF ACCOUNT INFORMATION. You agree that merchant authorization messages transmitted in connection with Point of Sale transactions are permissible disclosures of account information, and you further agree to release Bank of San Francisco and hold it harmless from any liability arising out of the transmission of these messages.

We will disclose information to third parties about your account or electronic fund transfers made to your account:

- Where necessary to complete a transfer or to investigate and resolve errors involving the transfer(s); or

- In order to verify the existence and condition of your account for a third party such as a credit bureau or merchant; or

- In order to comply with government agency or court orders; or

- If you give us your permission in a record or writing.

AMENDING OR TERMINATING THE AGREEMENT. We may change this agreement from time to time. You will be notified at least 21 days before a change will take effect if it will cause you an increase in costs or liability or it will limit your ability to make electronic fund transfers. No notice will be given if the change is necessary for security reasons. We also have the right to terminate this agreement at any time.

SAFETY PRECAUTIONS FOR ATM TERMINAL USAGE. Please keep in mind the following basic safety tips whenever you use an ATM:

- Have your Debit Card ready to use when you reach the ATM. Have all of your forms ready before you get to the machine. Keep some extra forms (envelopes) at home for this purpose.

- If you are new to ATM usage, use machines close to or inside a financial institution until you become comfortable and can conduct your usage quickly.

- If using an ATM in an isolated area, take someone else with you if possible. Have them watch from the car as you conduct your transaction.

- Do not use ATMs at night unless the area and machine are well-lighted. If the lights are out, go to a different location.

- If someone else is using the machine you want to use, stand back or stay in your car until the machine is free. Watch out for suspicious people lurking around ATMs, especially during the times that few people are around.

- When using the machine, stand so you block anyone else's view from behind.

- If anything suspicious occurs when you are using a machine, cancel what you are doing and leave immediately. If going to your car, lock your doors.

- Do not stand at the ATM counting cash. Check that you received the right amount later in a secure place, and reconcile it to your receipt then.

- Keep your receipts and verify transactions on your account statement. Report errors immediately. Do not leave receipts at an ATM location.

Your account is also governed by the terms and conditions of other applicable agreements between you and Bank of San Francisco.

Personal computer and modem (or network Internet connection) (collectively "Equipment") are required to access the Services:

Browser commercially available Internet browser with 128-bit encryption (most recent versions of Internet Explorer, Netscape, or America Online are compatible; contact the bank to verify)

EXCEPT WHERE THE LAW REQUIRES A DIFFERENT STANDARD, YOU AGREE THAT NEITHER WE OR THE SERVICE PROVIDERS SHALL BE RESPONSIBLE FOR DAMAGES, ERROR, LOSS, PROPERTY DAMAGE OR BODILY INJURY, WHETHER CAUSED BY THE EQUIPMENT, SOFTWARE, US, OR BY INTERNET BROWSER PROVIDERS SUCH AS NETSCAPE (NETSCAPE NAVIGATOR BROWSER) AND MICROSOFT (MICROSOFT EXPLORER BROWSER), OR BY INTERNET ACCESS PROVIDERS OR BY ONLINE SERVICE PROVIDERS OR BY AN AGENT OR SUBCONTRACTOR OF ANY OF THE FOREGOING, NOR SHALL WE OR THE SERVICE PROVIDERS BE RESPONSIBLE FOR ANY DIRECT, INDIRECT, SPECIAL OR CONSEQUENTIAL, ECONOMIC OR OTHER DAMAGES ARISING IN ANY WAY OUT OF THE INSTALLATION, USE OR MAINTENANCE OF THE EQUIPMENT, SOFTWARE, THE ONLINE BANKING SERVICES, INTERNET BROWSER, ACCESS SOFTWARE, THIS AGREEMENT, THE UNAVAILABILITY OF ONLINE BANKING SERVICE OR ANY ERRORS IN INFORMATION PROVIDED THROUGH THIS SERVICE, EVEN IF WE OR A SERVICE PROVIDER HAVE BEEN ADVISED OF OR ARE OTHERWISE AWARE OF THE POSSIBILITY THEREOF, EXCEPT AS LIMITED BY APPLICABLE LAW. THE MAXIMUM AGGREGATE LIABILITY OF US FOR ALL CLAIMS ARISING OUT OF OR RELATING TO THIS AGREEMENT, REGARDLESS OF THE FORM OR CAUSE OF ACTION, SHALL BE THE LESSER OF THE AMOUNT YOU ORIGINALLY PAID FOR THE SERVICE, PRODUCTS OR MATERIALS OR ONE HUNDRED U.S. DOLLARS. SOME STATES DO NOT ALLOW THE EXCLUSION OR LIMITATION OF INCIDENTAL OR CONSEQUENTIAL DAMAGES, SO THE ABOVE MAY NOT APPLY TO YOU.

To have access to the Services, you must be an authorized user of the Software you select. You must also have at least one eligible personal deposit or one non-personal deposit account with us. Only authorized persons can enroll in Online Banking. The bank reserves the right to deny application for Online Banking. Once enrolled, that person may have access to, or "link" any other bank account in which they are the primary SSN or TIN. No other person will have access to your bank account information unless you choose to give them your user ID and password. If you choose to give your Online Banking user ID and password to another person, that person will also have access to all other accounts that you have linked. If you wish to "unlink" accounts, you must notify the bank in writing and request that this be done. Accounts which are "linked" under the Services will have one common owner and signer. Any signer, acting alone, must be authorized to access a linked account. Any non-linked account will not be accessible through the Service unless you are the signer on the account, and you request that it be linked. A personal or non-personal account that requires two or more signatures to make withdrawals, transfers or transactions may not be designated as an eligible account. Each payment or transfer from your Money Market checking account is counted as one of the six transfers you are permitted each statement period.

YOU HEREBY RELEASE US FROM ANY LIABILITY AND AGREE NOT TO MAKE ANY CLAIM OR BRING ANY ACTION AGAINST US FOR HONORING OR ALLOWING ANY ACTIONS OR TRANSACTIONS WHERE YOU HAVE AUTHORIZED THE PERSON PERFORMING THE ACTION OR TRANSACTION TO USE YOUR ACCOUNT(S) AND/OR YOU HAVE GIVEN YOUR ACCESS CODES TO SUCH PERSON, OR, IN THE CASE OF A JOINTLY HELD ACCOUNT SUCH PERSON IS ONE OF THE OWNERS OF THE ACCOUNT. YOU AGREE TO INDEMNIFY AND HOLD US HARMLESS FROM AND AGAINST ANY AND ALL LIABILITY (INCLUDING BUT NOT LIMITED TO REASONABLE ATTORNEY FEES) ARISING FROM ANY SUCH CLAIMS OR ACTIONS.

Depending upon the particular features and the Equipment you select, you may be allowed access to the following Services by first entering your Customer ID and Password. Once validated on the Online Banking System, there is no additional sign-on required to access the specific services.

A stop payment order against a check is effective only against the check that is described in the stop payment request form and does not cancel or revoke the authorization for future checks written to the same payee. A stop payment order is effective for twelve (12) months only and will expire automatically at that time unless specifically renewed in writing prior to expiration. A stop payment order may be renewed for additional six-month periods.

I hereby order Bank of San Francisco to stop payment on the check(s) described in any stop payment request initiated via the Service. I warrant that the information describing the check(s), including the check date, its exact amount, the check number and payee is correct. I understand that if I give you any incorrect information, Bank of San Francisco will not be responsible for failing to stop payment on the check(s). I agree that unless my stop payment order is received by Bank of San Francisco within a reasonable time for Bank of San Francisco to act on my order prior to final payment of the check(s), Bank of San Francisco will not be responsible for stopping payment on the check(s). I understand that Bank of San Francisco shall not be responsible for failure to stop payment on a check if action has already been taken to pay the check. I also agree to notify Bank of San Francisco promptly upon the issuance of any duplicate check that replaces the check subject to this order, or upon return of the original check.

Through the use of certain Equipment and/or Software, you can use electronic mail ("e-mail") to contact us about inquiries, maintenance and/or problem resolution issues. E-mail is not a secure method of communication over the Internet and we recommend you do not send confidential information by e-mail. We will use reasonable efforts to contact you within 24 hours or the next business day. These responses are considered received, regardless of whether the customer has logged on and read them. You should never use unsecured Internet e-mail to initiate a transaction against your account.

Once you are an enrolled user of the Bank of San Francisco 's Online Banking Services, you may be charged the applicable Monthly Fee and/or Usage Fee whether or not you use the Services (please see the Bank of San Francisco Fee Schedule). You authorize us to automatically deduct all applicable charges and fees from your eligible Bank of San Francisco account. You may also be charged additional fees that may be assessed by your Internet Service Provider and you may be assessed additional fees by your telephone company.

You will be mailed periodic statements for your eligible Bank of San Francisco account(s) with the regularity provided for in the depositor, credit card, overdraft protection and line of credit agreements. In addition to reflecting your other account activity, your statements will include any transfers or Bill Payments you authorize using the Online Banking Services.

If you believe that an unauthorized transaction has been or may be conducted from one of your eligible personal or non-personal Bank of San Francisco accounts without your permission, call 415-744-6700 or write

345 California Street, Suite 1600, San Francisco, California 94104.

If you do not report unauthorized transactions that appear on any of your periodic statements within 60 days after such statements are mailed or electronically transmitted to you, you risk unlimited losses on transactions made after the 60-day period if we can prove that we could have prevented the unauthorized use had we been notified within this 60-day period.

- Tell us your name and account number(s).

- Describe the suspected error or the nature of the problem, or describe what information you need.

- Tell us the dollar amount of the suspected error.

Our business days are Monday through Friday, except Federal bank holidays and state holidays that may be observed.

Although electronic Bill Payment transactions can be processed only on business days, you can use your Equipment to send us e-mail 24 hours a day, seven days a week, except during any scheduled maintenance periods.

You are responsible for all Bill Payment you authorize using the services. If you permit other persons to use the Service or your Access Codes, you are responsible for any transactions they authorize from your eligible personal or non personal Bank of San Francisco deposit accounts. Tell us AT ONCE if you believe your Access Code has been lost or stolen. Telephoning is the best way of keeping your possible losses down. You could lose all the money in your account (plus your maximum overdraft line of credit). If you tell us within two business days after your reasonable discovery of the loss or theft, you can lose no more than $50 if someone used your Access Code without your permission. If you do NOT tell us within two business days after you learn of the loss or theft of your Access Code, and we can reasonably prove we could have stopped someone from using your Access Code without your permission if you had told us, you could lose as much as $500. Also, if your statement shows transfers that you did not make, tell us at once. If you do not tell us within 60 days after the statement was mailed to you, you may not get any money you lost after the 60 days if we could have stopped someone from taking the money if you had told us in time. If you believe your Access Code has been lost or stolen or that someone has transferred or may transfer money from your account without your permission, call 415-744-6700 or write to us at

345 California Street, Suite 1600, San Francisco, California 94104.

We or a third party acting as our agent, are responsible for completing fund transfers and Bill Payments from your personal account(s) on time according to your properly entered and transmitted instructions.

- IF YOU DO NOT HAVE ADEQUATE MONEY IN A DEPOSIT ACCOUNT TO COMPLETE A TRANSACTION FROM THE ACCOUNT, OR IF THAT ACCOUNT HAS BEEN CLOSED OR FROZEN;

- IF THE TRANSFER WOULD CAUSE YOUR BALANCE TO GO OVER THE CREDIT LIMIT FOR ANY CREDIT ARRANGEMENT SET UP TO COVER OVERDRAFTS;

- IF YOU HAVE NOT PROPERLY FOLLOWED SOFTWARE OR SERVICE INSTRUCTIONS ON HOW TO MAKE A TRANSFER;

- IF YOU ATTEMPT TO TRANSFER FUNDS BETWEEN ACCOUNTS FROM DIFFERENT BANKS (USING THE FUNDS TRANSFER OPTION);

- IF YOU, OR ANYONE YOU ALLOW, COMMITS ANY FRAUD OR VIOLATES ANY LAW OR REGULATION;

- IF YOUR EQUIPMENT AND/OR SOFTWARE, THE BANK'S EQUIPMENT AND/OR SOFTWARE, OR THE PHONE LINES WERE NOT WORKING PROPERLY;

- IF CIRCUMSTANCES BEYOND OUR OR OUR AGENT'S CONTROL PREVENT MAKING A TRANSFER OR PAYMENT, DESPITE REASONABLE PRECAUTIONS THAT WE HAVE TAKEN. SUCH CIRCUMSTANCES INCLUDE, BUT ARE NOT LIMITED TO, COMPUTER FAILURE, TELECOMMUNICATION OUTAGES, POSTAL STRIKES AND OTHER LABOR UNREST, DELAYS CAUSED BY PAYEES, FIRES, FLOODS, OTHER NATURAL DISASTERS; OR ANY ELECTRONIC TERMINAL, TELECOMMUNICATION DEVICE OR ANY PART OF THE ELECTRONIC FUND TRANSFER SYSTEM IS NOT WORKING PROPERLY;

- IF YOU OR WE HAVE TERMINATED YOUR Online Banking SERVICE OR CLOSED THE ACCOUNT.

We may collect nonpublic personal information about you from the following sources:

- Information we receive from you on applications or other forms.

- Information about your transactions with us or others.

- Information we receive from consumer reporting agencies.

Except for California residents, we may disclose all of the information we collect, as described within the three bullet points above, to non-affiliated companies that perform marketing services on our behalf or to other non-affiliated financial institutions with which we have joint marketing agreements.

We may, on a regular basis, perform maintenance on our equipment or system, which may result in interrupted service or errors in the Service. We also may need to change the scope of our Services from time to time. We will attempt to provide prior notice of such interruptions and changes but cannot guarantee that such notice will be provided.

YOU AGREE THAT OUR LIABILITY FOR VIRUSES, WORMS, TROJAN HORSES, OR OTHER SIMILAR HARMFUL COMPONENTS THAT MAY ENTER YOUR COMPUTER SYSTEM BY DOWNLOADING INFORMATION, SOFTWARE, OR OTHER MATERIALS FROM OUR SITE SHALL BE LIMITED TO REPLACING, OR THE REASONABLE COST OF REPLACING, THE LOST INFORMATION, SOFTWARE OR OTHER MATERIAL. WE WILL NOT BE RESPONSIBLE OR LIABLE FOR ANY INDIRECT, INCIDENTAL OR CONSEQUENTIAL DAMAGES THAT MAY RESULT FROM SUCH HARMFUL COMPONENTS.

IN NO EVENT SHALL WE BE LIABLE TO YOU FOR ANY CONSEQUENTIAL, INCIDENTAL OR INDIRECT DAMAGES ARISING OUT OF THE USE, MISUSE OR INABILITY TO USE THE ONLINE SERVICES, OR FOR ANY LOSS OF ANY DATA, EVEN IF WE HAVE BEEN INFORMED OF THE POSSIBILITY OF SUCH DAMAGES. WE MAKE NO WARRANTY TO YOU REGARDING THE EQUIPMENT OR THE SOFTWARE, INCLUDING ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR PARTICULAR PURPOSE.

In order to maintain secure communications and reduce fraud, you agree to protect the security of your numbers, codes, marks, signs, public keys or other means of identification. We reserve the right to block access to the Services to maintain or restore security to our Site and systems, if we reasonably believe your access codes have been or may be obtained or are being used or may be used by an unauthorized person(s).

The reproduction or distribution of the content and information on our site is strictly prohibited.

Wherever possible, each provision of this agreement shall be interpreted in a manner which makes the provision effective and valid under applicable law. If applicable law prohibits or invalidates any part or provision of this agreement, that particular part or provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this agreement.

The rights and remedies provided by this agreement are cumulative and the use of any one right or remedy by any party shall not preclude or waive the right to use any or all other remedies. Said rights and remedies are given in addition to any other rights the parties may have by law, ordinance or otherwise.

The obligations of the Bank shall be suspended to the extent and for so long as such obligations are hindered or prevented from being performed on account of labor disputes, war, riots, civil commotion, acts of God, fires, floods, failure of suppliers and/or subcontractors to perform, failure of power, restrictive governmental law and/or regulations, storms, accidents or any other cause which is reasonably beyond the control of the Bank.

This agreement contains the entire agreement between the parties and no statements, promises or inducements made by either party or agent of either party that are not contained in this written agreement or other documents referenced by this agreement. This agreement may not be enlarged, modified or altered except in writing in accordance with the above provisions.

This Agreement shall be governed by and interpreted under California and Federal Law.

We may amend this agreement (including changes in its fees and charges hereunder) by giving notice to you at least 30 days before the effective date of the amendment, unless such change or amendment is otherwise required by law or applicable regulation and unless prior notice is excused by law. Your continued use of the Services is your agreement to the amendment(s). Depositor's credit card, overdraft protection and line of credit will continue to apply in accordance with our published Schedule of Fees, as amended from time to time.

We may waive any term or provision of this agreement at any time or from time to time, but any such waiver shall not be deemed a waiver of the term or provision in the future.

We may assign the rights and delegate the duties under this Agreement to any other party.

Except as provided above, we may terminate this agreement and any service provided hereunder at any time upon ten (10) business days prior written notice of termination to you. We reserve the right to terminate or to discontinue support of any software or equipment without written notice.

YOU AGREE THAT ALL OF THE PROVISIONS OF THIS AGREEMENT ARE ENFORCEABLE AS YOU HAVE EQUAL BARGAINING POWER AND HAVE ENTERED INTO ALL PROVISIONS VOLUNTARILY AFTER A FULL REVIEW AND UNDERSTANDING OF THIS AGREEMENT WITH ANY DESIRED LEGAL, ACCOUNTING OR OTHER ADVISOR, AND YOU AGREE TO SPECIFICALLY WAIVE, IF LAWFUL, ANY STATUTORY PROVISION, CASE LAW OR OTHER LEGAL AUTHORITY WHICH IS IN ANY WAY CONTRARY TO AND/OR NULLIFIES/VOIDS ANY PROVISION OR PORTION OF A PROVISION OF THIS AGREEMENT, INCLUDING, BUT NOT LIMITED TO, ANY REQUIRED AGREEMENT FORMALITY.

2. Reduce your checkbook balance by the amount of any service charges not previously deducted.

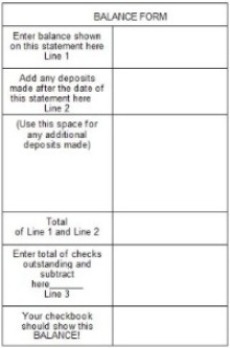

3. Enter the balance shown on this statement on Line 1 of the balance form below.

4. Enter any deposits made after the date of this statement on Line 2 of the balance form and add them to the statement balance.

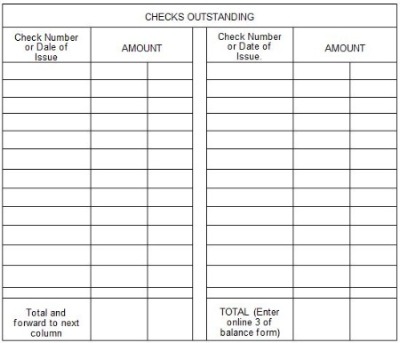

5. List and total all checks issued but not paid in the "Checks Outstanding" columns below. Enter this total on Line 3 of the balance form and subtract.

6. The remaining balance should be the same as your checkbook balance. If the final balances do not agree, recheck the accuracy and completeness of all entries and computations. Any irregularity on the statement should be reported to the bookkeeping department at once.

Call or write to us as soon as you can if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or the receipt. Our address is 345 California Street, Suite 1600, San Francisco, California 94104 and telephone number is 415-744-6700. We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared.

(1) Tell us your name and account number (if any)

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe there is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

We will determine whether an error occurred within 10 business days (20 business days for new accounts) after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question (90 days on new accounts, point-of-sale debit card transactions, or transfers initiated out of state). If we decide to do this, we will credit your account within 10 business days (20 business days for new accounts) for the amount you think is in error, so that you will have use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account.

Finance Charges are imposed on advances as of the date of posting and continue to accrue until paid in full. We calculate the Current Finance Charge on your account by multiplying the Daily Periodic Rate by the Average Daily Balance on your statement including current transactions and then multiplying by the Days in the statement cycle. To get the Average Daily Balance we take the beginning balance of your account each day, add any new advances or other debits for that day, and subtract any payments or credits and any unpaid Finance Charges. This gives us the daily balance. Then we add up all the daily balances for the statement cycle and divide by the Days in the statement cycle. This gives us the Average Daily Balance. The billing cycle ends on the Closing Date. If your account is subject to a variable interest rate, your periodic rate may vary.

If you think your bill is wrong, or if you need more information about a transaction on your bill, write us on a separate sheet of paper at our address shown on the front of this statement as soon as possible. We must hear from you no later than 60 day after we sent you the first bill on which the error or problem appeared. You can telephone us, but doing so will not preserve your rights. In your letter, give us the following information: 1) your name and account number, 2) the dollar amount of the suspected error, 3) describe the error and explain, if you can, why you believe there is an error. If you need more information, describe the item you are unsure about.