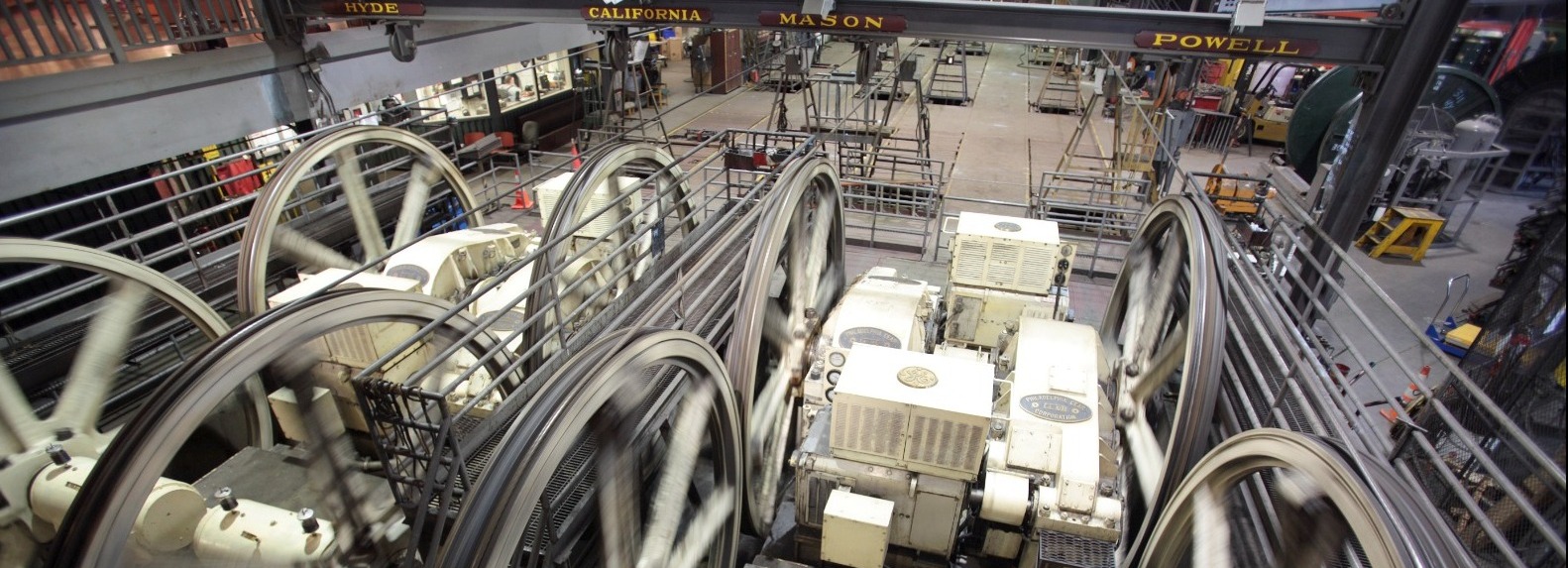

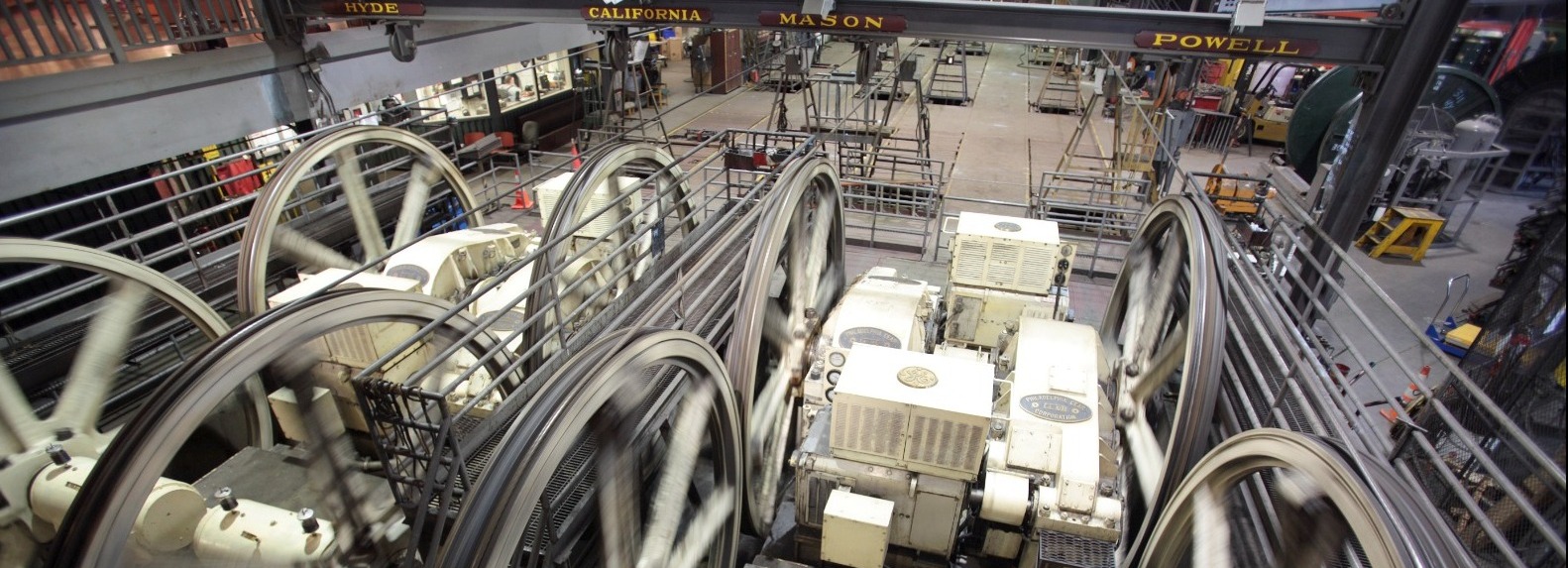

Cable Car Museum in Nob Hill

With Bank of San Francisco’s digital banking services, you can manage your finances when it’s most convenient for you. Our online portal and mobile app provide 24/7 access to your accounts — with the security and personal support you expect from us.

With Digital Banking, You Can:

*Learn more about Zelle® here. U.S. checking or savings account required. Transactions between enrolled users typically occur in minutes. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.